Which Accurately Describes the Requirements Banks Must Meet

A fractional reserve banking system is a requirement by the government in order to improve and maintain bank liquidity. When the required reserve ratio is raised banks have less incentive to give loans because they make less profit on these loans.

4 5 2 Test Money Money Money Flashcards Quizlet

BUS 100 Introduction to Business Unit 4 Challenges Sophia Course Challenge 1 Which of the following is NOT something proper financial management can ensure.

. And return of unpaid checks and describes require ments that affect banks that create or receive substitute checks including requirements related to consumer disclosures and expedited recredit procedures. In other words - any function constraint or other property that is required in order to satisfy users needs. Banks reserve the right to raise interest rates at any time.

Banks must keep a specific percentage of deposts on hand B. Commercial bank Which type of non-profit institution requires that a person must meet certain guidelines to become a member before they can take advantage of the institutions services. Infrared And Ultraviolet Visible Spectroscopy Questions Practice Khan Academy.

When the required reserve ratio is raised banks can loan out a larger portion of their reserves. When the required reserve ratio is raised banks must loan out a smaller portion of their reserves resulting in fewer loans. Be impossible to meet customers demands for.

In addition to reforming the financial services industry the Act addressed concerns relating to consumer financial privacy. The Pale Horse Movie Ending Explained. A Multiplexer or Mux Does Which of the Following.

For business collateral lenders also consider equipment and inventory. Which Accurately Describes the Requirements Banks Must Meet. Banks typically seek structural collateral for larger loans such as a home or an office.

Checks and electronic checks and describes requirements that affect banks that create or receive substitute checks including requirements related to consumer disclosures and expedited recredit procedures. Which of the following accurately describes the requirements banks must. Describes how raising the required reserve ratio reduces the money supply.

A filter bank consisting of high-index-contrast microring-resonator filters with accurately spaced resonant frequencies can meet these requirements. Banks must pay a specific fraction of their assets in taxes. Banks must get government approval for all loans.

The expected useful life of your collateral must match the lifespan of the business loan. Regulation CC contains four subparts. This paper describes the basic architecture of microring-resonator filter banks and how to maximize performance while keeping fabrication challenges reasonable.

Which of the following is the purpose of requiring banks to keep a specific percentage of their deposits on hand in the vault. The first three implement the EFA Act and the fourth implements Check 21. Bariks must pay specific fraction of their assets in teles.

The Gramm-Leach-Bliley Act required the Federal Trade Commission FTC and other government agencies that regulate financial institutions to. User requirements are gathered from users and described from the. By requiring banks to keep a specific percentage of deposits on hand the government protects banks and their clients from the banks being insolvent from too many demands.

Banks must keep a specific percentage of deposits on hand. Aside from the customer needs - the products requirements include all functions features and behaviors that the product must possess so that it will be efficient ease to use safe low cost etc. Banks must keep a specific percentage of deposits on hand.

The first three implement the EFA Act and the fourth im plements Check 21. Other forms of collateral include automobiles expensive jewelry and high-end antiques. Regulation CC contains four subparts.

Which of the following accurately describes the requirements banks must meet under a fractional reserve banking system. Banks must get government approval for all loans C. Which of the following accurately describes how raising the required reserve ratio reduces the money supply.

Banks must keep a specific percentage of deposits on hand. ABOUT THE GLB ACT The Gramm-Leach-Bliley Act was enacted on November 12 1999. 21 Which of the following statements most accurately describes the task of bank from ECON 303 at University of North Dakota.

A An improved credit rating b The availability of sufficient financing c The availability of money for immediate cash flow problems d Effectively planning and controlling spending An. Which of the following accurately describes the requirements banks must meet under a fractional reserve banking system.

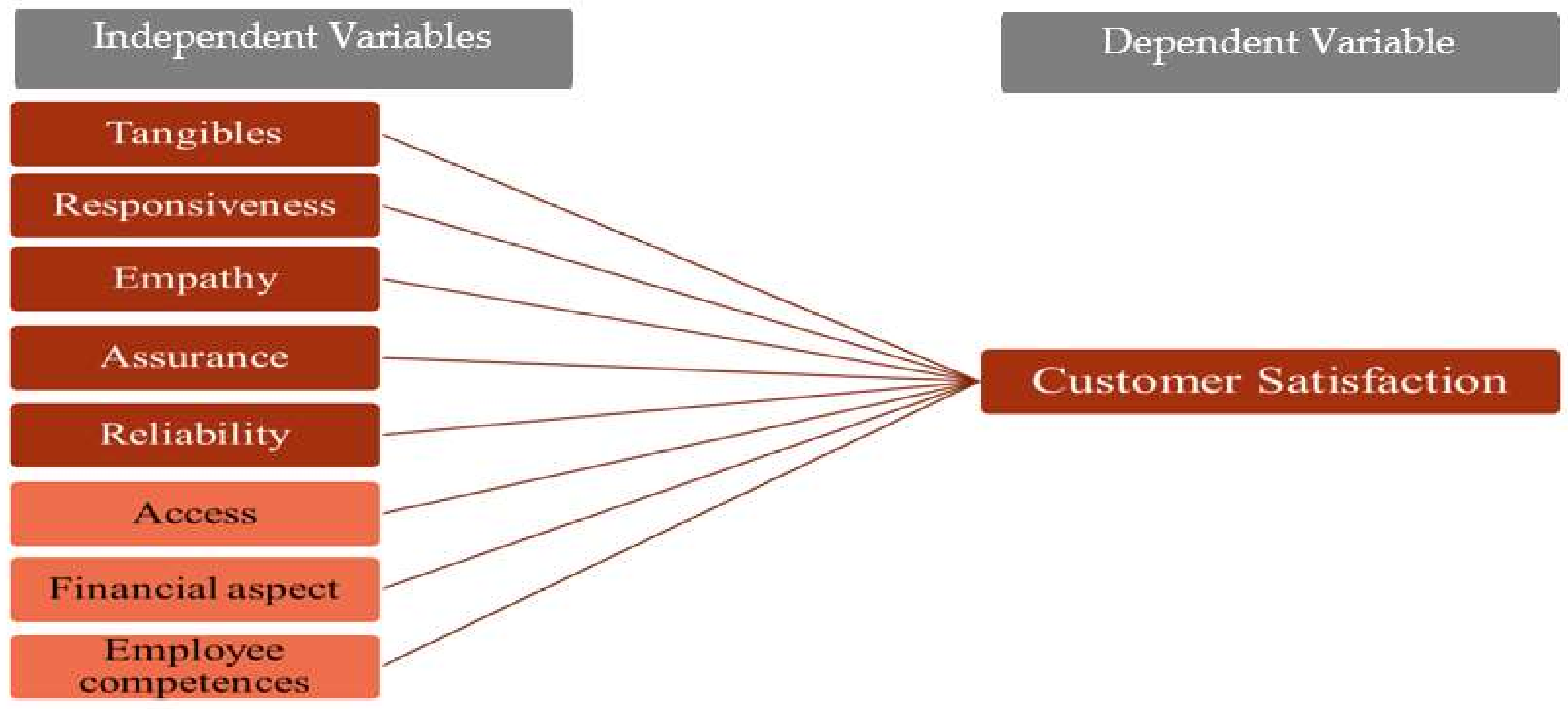

Sustainability Free Full Text The Service Quality Dimensions That Affect Customer Satisfaction In The Jordanian Banking Sector Html

No comments for "Which Accurately Describes the Requirements Banks Must Meet"

Post a Comment